Saving for a New Future

I am a millennial and I have watched how drastically the retirement savings scene has changed over the generations.

It was not long ago that planning for the future was a pretty clear and certain path. Get married in your early to mid-twenties, have 2.5 children, work in a career job that offers good benefits, buy a house, and live your American dream life.

Gen-X, Gen-Y (Millennials), and Gen-Z seem to be fuzzier on what the path is with every year that pasts. Our culture is getting married later, married more times (divorces), changing jobs more frequently, being unable to save for retirement, and being caught in an endless cycle of making ends meet.

In this blog, I want to just focus on the finances of how we can begin to navigate and save for this new future we are facing.

Take Responsibility for Your Retirement

I am a millennial and I have watched how drastically the retirement savings scene has changed over the generations. My granddad worked for APS for 30+ years, paid off his house, had a pension, and was able to retire at an early age. My dad paved his own path and worked in the Aerospace industry for 30+ years, built company 401ks, and retired at an earlier age than most. Those formulas are becoming increasingly harder to follow; companies rarely offer pensions and employees rarely stay at a company long enough to let that 401k be their main engine of retirement.

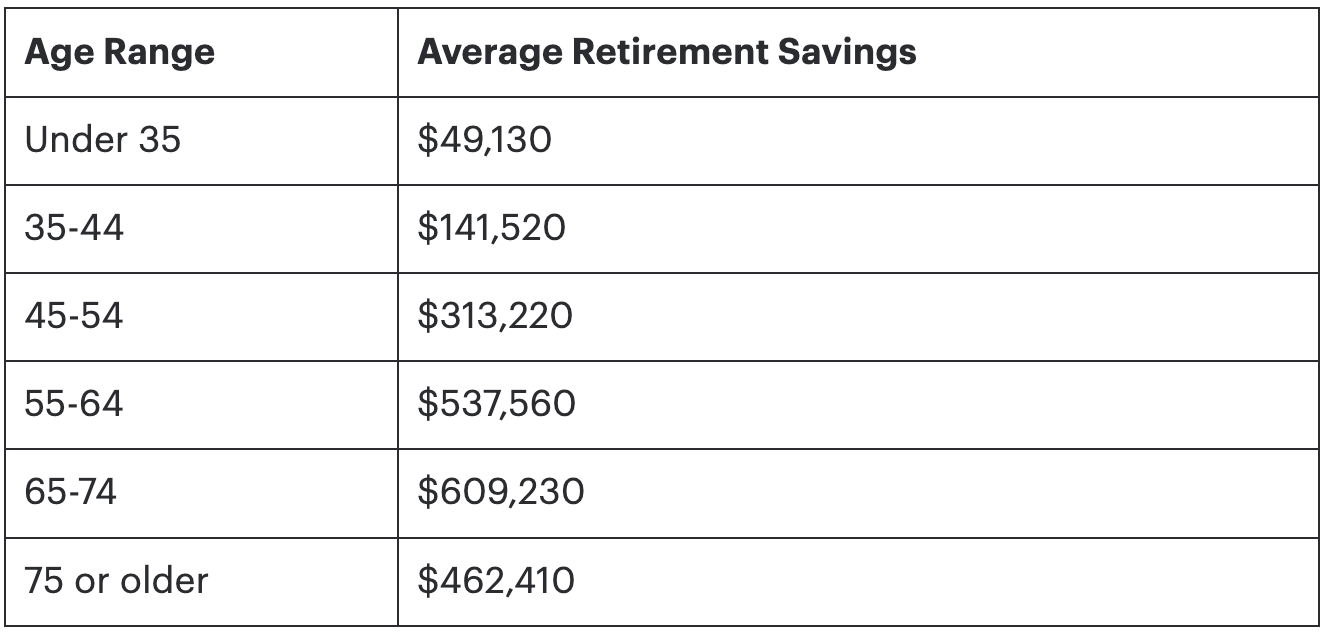

Millennials and Gen-Z increasingly have little to no plans on how they are going to retire, check out some of the latest stats from the Federal Reserve.[1]

You may look at those numbers and see them as high or low compared to your situation, but the reality is those are numbers that make retirement an almost impossibility especially when not considering debt. The problem that is far too common is the average person has numerous partially funded 401ks or other retirement accounts from the companies they jump around to every 3-4 years with no external investments outside of a few Acorn stocks.

Gone is the era of working at a company for 30-40 years, getting a pension, fully funding a 401k, and that being your main retirement engine. It takes creativity and personal responsibility to have retirement savings OUTSIDE of just your job.

Choose Your Wealth-Building Method

Retirement is possible when effective wealth-building methods are deployed. Investing 101 talks extensively about this when you allow compound interest to build, you let value increase, and whatever method you use starts doing the work of wealth-building on its own.

I am not a financial advisor, I am a pastor, I have an undergrad in Business Management, but my calling took me on a different career path. However, I would argue that all of us have the resources to find how we can personally be disciplined in building for retirement. The best advice I received early on was to start a Roth IRA for myself and then when I got married to my wife. Since we were married in our early twenties, I have maxed out those for both of us and that is the driving engine of our retirement and does not depend on a company or organization to fund it. Others dive into real estate or trading and investing in specific stocks, the point is to do your research and find what works for you. If you have no idea where to start, check out Dave Ramsey’s beginner guide for investing here: https://www.ramseysolutions.com/retirement/how-to-start-investing

I’m a believer in a Roth IRA because it was a path that I could start before going into ministry, continue while in ministry, and pursue my calling while realistically building for retirement. The point is that you need to do something that can fit your lifestyle, is achievable within your scope, and is forward-thinking for your future.

Why Do I Need to Retire?

Some will make a theological argument that retirement isn’t even biblical, but I would say there is a difference between retiring from work to make money and retiring from your work as a Christian. Do you ever retire from your task, your mandate, your new life as a follower of Jesus Christ? No, we are called to continually be a part of the church, to Make Jesus Known everywhere we go. But, to financially retire is not just a selfish endeavor to ride off into the sunset, it’s a discipline so that you will not become a burden or hindrance to those around you.

Paul discusses this concept in 2 Corinthians 12:14 “I will not burden you, since I am not seeking what is yours, but you. For children ought not save up for their parents, but parents for their children.” If we do not live disciplined lives that save for retirement and if we reach an age where we can no longer work to provide for ourselves, then we will naturally become a burden. That may be a burden to our government which becomes a burden to all taxpayers or what often happens is we become a burden to our children and family members who feel obligated to provide for us.

As followers of Jesus, we are not motivated by greed and money, but we should also not be motivated by laziness and lack of discipline. Not saving for the future is prioritizing our comfort over our discipline and sacrificing our future or the future of those close to us in the process.

I pray that in the changing economic culture that our generations are facing, we can be people who save for the future by taking personal responsibility, finding the method that works best for us, and ultimately starting NOW instead of waiting for later.

[1]https://www.federalreserve.gov/econres/scf/dataviz/scf/table/#series:Retirement_Accounts;demographic:agecl;population:all;units:median